Death by Discount

Death by Discount

Is Your Discounting Killing Your Business?

You sink a lot into your business — your time, money, stress. But there is no guarantee your business will ever repay you. The potential profits will stay hidden until you uncover them. To uncover them you need a high profit business design.

The key to designing your business for high profits is to focus your energy in the right places. Perhaps the most dramatic and easiest improvements can come from focusing on your prices. An example below will show you how increasing prices by 10% can increase bottom line profits by 50%.

But price increases will lose you business right?

Our natural tendency is to undervalue our products and services. It’s personal — we find it hard to ask for a ‘high’ price; especially when we’re starting out in business. We think we have to offer more for less to get business.

But that is usually not the case. People will pay what they perceive your products and services to be worth. You do provide value to your customers. Chances are you are not charging enough for that value.

How much should you charge?

First make sure you know your numbers. Calculate the true cost of delivering each unit of product or service. This includes the purchase cost to you of the product, direct labour costs, freight in and out, your time etc. Include every cost that will increase when you sell one more product or service unit. This is the cost of sales in the example on the following page.

Next calculate your profitability. The business in the example below sells wooden ornaments. They are currently selling 2,000 units per year at an average sale price of $100. Each product costs the business $65 all up, delivered to the customer. After deducting the cost of sales of the 2,000 units per year ($130,000), and fixed indirect expenses of $30,000, the net profit left over for the business owner is $40,000.

If the business is typical they could probably get a bit more for their products. Say they increase their prices by 10%. Assuming their volume of sales stays the same look at the change in net profit. The 10% price increase gives a whopping 50% increase in net profit!

But if you increase your prices you’ll sell less won’t you?

Well that depends on the product. If you are undercharging now you will lose little if any sales volume. But assume your customers are price sensitive. Maybe you face stiff competition. How much can your sales volume go down, before you lose out on your bottom line?

The next example shows volume dropping by 22% in response to the 10% price increase. At this change (a fairly dramatic response to the price increase) the business still maintains the same bottom line Net Profit.

So if sales volume falls by more than 22% profit goes down, less than a 22% volume drop and profit goes up.

Beware of going the other way

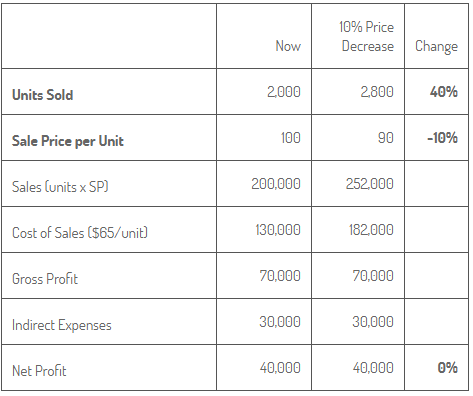

And if you’re tempted to discount your prices to gain more business, the increase in volume needed to maintain your profit is even more dramatic. Look at this example with a 10% decrease in price:

A 40% increase in sales volume is needed to maintain the $40,000 net profit. This may be possible if it’s combined with a significant marketing campaign. But that is a big increase in anyone’s books.

The more differentiated your product or service, the less sensitive the sales volume is to price changes. Differentiate yourself from your competition with your branding, your service and relationships with your customers. Unless you are selling a true commodity, you can maintain sales volume with higher prices.

Real Life Examples

If you are still nervous about increasing your profits let me tell you a real example. I sent a newspaper article to a client about a competitor of hers. The article gave her competitor’s prices which were significantly higher than hers. She immediately put her prices up to match. With no other major changes in her business, a year later her profits were up 59%.

And a hair salon client of mine once told me they couldn’t understand why they weren’t busier. “We charge less for a better quality service than our competitors so why aren’t we flat out?” She asked. After asking her why her prices were lower, she could give me no good reason. So after a few weeks of thinking about it she increased all her prices. And she was amazed when she did not lose a single customer.

Even if your sales volume decreases and your profits remain the same, it will free up your most precious resource — your time. Now you can work on developing other areas of your business, and/or take more time off.

Don’t let low prices bury your profits. If you really can’t raise your prices, improve your perceived value so you can.

Are you missing out on potential profits?

We are accountants for professionals and consultants. As an expert in your field, your knowledge generates value for your clients. Our job is to make sure that value also generates your financial success.

Contact us with your business questions.