What are Profit Margins and Why Do They Matter

What are Profit Margins and Why Do They Matter?

Profit margins (also called margins) matter because they are the percentage of sales that the business owner keeps. Sales of $100,000 with a profit margin of 20% generates a profit of $20,000. In other words, 80% of the sales value was used to generate the sale, leaving 20% for the business owner.

A change in margin has a greater impact on profit than an equivalent percentage change in sales. The lower the margin to start with, the bigger impact a change in the margin has.

In our example above, to achieve a $1,000 increase in profit with no change in margin, we need to increase sales by 5%, or $5,000:

Alternatively, to achieve the same increase in profit with no change in sales, we need to increase margin by just 1%:

Gross Profit Margin and Net Profit Margin

Profit can be further broken down into gross profit and net profit. Gross profit is the profit after deducting just the costs directly incurred to deliver the product or service. These direct costs, often called cost of sales, will vary as the sales volume varies.

When a bike shop sells one bike, there is a cost of that sale being the cost the shop paid for the bike. If the shop sells a bike for $1,000 after paying $600 for it, it makes a 40% gross margin on the sale.

Presuming a business has similar gross margins across all its products, the cost of sales will change approximately in proportion to sales.

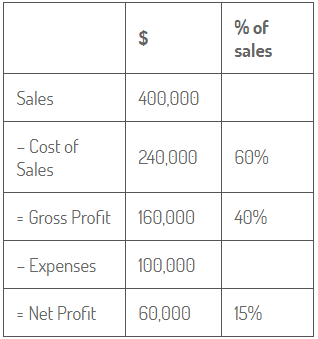

Let’s say our bike shop sells $400,000 worth of bikes in a year, with an average gross margin of 40%. Gross profit is $160,000:

Now, let’s say the shop has other expenses of $100,000 including rent, power and wages. These expenses are generally fixed, regardless of sales. These expenses are deducted from the gross profit to get to net profit.

Our bike shop has a net profit of $60,000 and a net profit margin of 15%.

While net profit is ultimately what matters, because net profit is what we keep, our gross margin is where we can influence our results. We make one-off decisions regarding fixed expenses such as whether to rent an expensive shop in a high foot-traffic area or a cheaper shop in a quiet side street. But once these decisions are made, we can’t change them month to month.

Where we can make a difference in the short-term is by focusing on our sale prices and deals with suppliers to try and improve our gross margins. I.e., widen the gap between sales and cost of sales. A small increase in gross margin converts to a large increase in net margin.

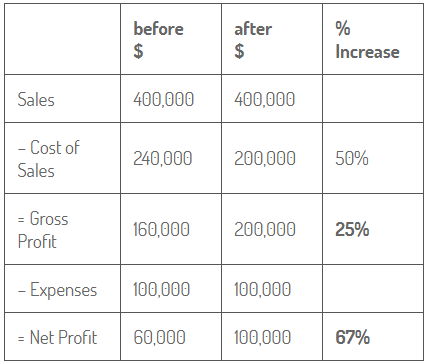

What if our bike shop managed to negotiate a lower cost from a new supplier and increased its gross margin from 40% to 50% of sales. This 10% increase in gross margin results in a 25% increase in gross profit, from $160,000 to $200,000.

The difference is magnified at net profit level. The 25% increase in gross profit converts to a 67% increase in net profit.

Margins are important and a modest improvement in gross margins, without adversely affecting other factors, can drastically change net profit. And net profit is what you can bank. It’s called the bottom line for a reason.

Contact us with your business questions.