New Medical Practice Checklist – How to get started

/in Business Essentials, Business Development, News, Strategic Accounting/by michelle.adminChoosing an Accounting System for your Small Business

/in Strategic Accounting, Business Development, Business Essentials, News/by michelle.admin7 Strategies for Surviving a Recession

/in Strategic Accounting, Business Development, Business Essentials, News/by michelle.admin7 Reasons You Need a Cash Flow Forecast

/in Strategic Accounting, Business Development, Business Essentials, News/by michelle.adminRatios – Making Sense of your Numbers

/in Business Development/by wp.adminRatios Making Sense of your Numbers

How to Make Sense of Your Financial Statements

Often when I show a client a financial report, they respond with a blank stare. When I point out a figure in the report, such as their net profit, they may ask something like: “is that good?”.

They are appropriate responses because numbers can seem meaningless on their own. Only when they are put into some context do they become useful, which is where ratios come in.

Is that a good profit?

A ratio compares the relationship between more than one number, giving them context. For example, the net profit margin is the percentage of your revenue (or sales) left after deducting all your business expenses. It is important because it shows how efficiently you turn your revenue into profit.

If your financial statements show a net profit of $80,000 and revenue of $400,000, your net profit margin is 20% (80,000 / 400,000 x 100%).

To put it another way, your net profit is your revenue multiplied by your net profit margin. The higher the margin the more of your revenue you keep:

Net Profit = Revenue x Net Profit Margin

($400,000 x 20% = $80,000).

Using ratios, we now have a measure that we can put into context.

Meaning comes from comparing

If your revenue had been $500K instead of $400K, but your net profit margin only 15% instead of 20%, you would have only made a profit of $75K ($500,000 x 15% = $75,000). So, focusing on growing fees without maintaining margin is no use. You can be working a lot harder for less money.

Industry comparisons

So, is our 20% net profit margin good? The best indicator is a comparison to other businesses in the same or a similar industry. If we are an independent consultant, comparing our $80,000 net profit with a top four consulting firm would be meaningless – and depressing – but comparing our net profit margin is useful.

Taking our 20% net profit margin, if others in our industry are achieving 13%, we are very efficient. Maybe we have lower overheads, or we are focused on high margin services while they cover a wider range.

Benchmarking figures are available from various sources for different industries and can be sliced and diced into regions, business sizes etc to get meaningful comparisons.

Internal comparisons

By comparing our ratio with previous years, we can see if we are getting better or worse.

By comparing our ratio with our budget, or target figures, we can see if we are heading towards our goals and budgets or not.

Good decisions are based on good management information and our ratios will reveal where we can concentrate our efforts to achieve the most dramatic impacts on our results.

Let’s look at another couple of examples.

Paying the bills

It is one thing to make a profit, but it’s no use until we collect it. Profitable, growing businesses still collapse when they can’t collect it quickly enough to pay their bills.

The current ratio is a measure of our ability to pay our bills. It compares our current assets (money we will collect in cash in the short-term) with our current liabilities (money we will have to pay out in the short-term).

Our current assets include money in the bank and debtors. Current liabilities include creditors, upcoming tax payments and other short-term financial obligations. The current ratio shows us how much we have in current assets to cover our current liabilities. I.e., how much money we have coming in to pay our bills.

Current Ratio = Current Assets / Current Liabilities

If our financial statements show current assets of $45,000 and current liabilities of $45,000, we have a current ratio of 1. Whether this is good or not depends on the industry we are in.

A supermarket can survive on a low current ratio as they have a plentiful supply of cash sales coming in each day. A consultant may need a much higher ratio. It takes time to deliver services, get them invoiced, then collect the money. While some businesses may be comfortable they can pay their bills with a current ratio under 1, a consultant may need a ratio over 2.

Getting new clients

Ratios can be used to measure all parts of our business, not just our financial results. To grow our client base, we need to convince people who are interested in our services to become clients. The rate of turning these leads into clients is our conversion rate.

Conversion Rate = No. of Sales / No. of Leads x 100%.

If ten people enquire about our services, and two of them become clients, we have a 20% conversion rate (2 / 10 x 100%).

If we are generating plenty of enquiries but few new clients, improving our conversion rate will have a big impact on our results. We may need to work on our sales pitch.

If our conversion rate is high, concentrating on generating more leads will bring us many more clients. We may need to increase our marketing efforts.

Using ratios effectively

The first step to improving business performance is getting meaningful information that shows us where our business is at now. Armed with this information, we can understand what needs to change for the biggest impact on our results.

There are unlimited potential measures but the fewer we focus on the more energy we can put into changing them. A good business dashboard may contain four different measures covering four different parts of the business.

As management accountants, we help you take your business beyond guesswork and focus your efforts where they will get the greatest return.

Contact us with your business questions.

Managing Your Cash Flow

/in Business Development/by wp.adminManaging Your Cash Flow

Why we run out of cash

We know our business needs cash flow. We need cash to:

- Finance growth – growth eats resources including cash

- Take opportunities

- Prevent resources being sucked up in dealing with creditors and financiers

- Pay ourselves properly – if we are not paying ourselves a market salary, we are personally funding the business

But ultimately, we need cash to stop our business from failing. Otherwise successful and profitable businesses fail when they can’t pay their bills.

Cash is the ultimate “lagging indicator” of business success, meaning it is the final result of all our business efforts.

- Resources are invested into providing services (or products)

- Hopefully, these services create a profit

- Finally, the profit is collected in cash

Resources, including cash, are invested in the business process before it generates more cash creating a gap between cash invested and cash generated. This gap is magnified when a business is growing as more resources are needed to fund the increased business before the resulting increased cash is generated.

Where do we get the cash funding from?

Businesses are funded from either internal operations or external sources. When we cannot generate enough cash quickly enough from our business operations, we need to use external funding. But external funding, whether debt (borrowing money) or equity (selling part of the business), comes at a cost.

Debt finance

The costs of raising debt finance include:

- Our time and energy collating information for potential lenders

- The financial cost of the debt, including interest and loan fees

The financial cost puts a further burden on our business by using cash to service it. We must generate more cash internally in future to cover the cost.

Equity finance

The costs of raising equity finance include:

- Our time and energy finding an investor and arranging the deal

- A share of our future profits – an equity investor buys an entitlement to all future cash flows of the business

- Accountability to someone else

- Friends and family investors may be less financially demanding but more emotionally demanding, especially when things don’t work out

- a pure business investor may demand less emotional investment, but invests for a return and will want some say in how the business generates that return

Cash funding with the lowest cost, in all respects, is internally generated cash. Our first job is to ensure we finance as much of our business needs as possible from our operations. How do we do that when it takes time to get to the cash collection?

Our cash conversion cycle

By understanding our business operations’ process of turning cash investment into cash generation, we can improve the process, increasing our internal funding and decreasing our need for external funding.

How does it work?

Let’s look at the cash conversion cycle which calculates the days taken to turn cash investment into cash generated:

CCC = WIP days + Debtor days – Creditor days

A typical professional services or consulting business has this process:

WIP days

When a client job is started, direct labour costs (or our time if doing it ourselves) and job disbursement costs are invested to create Work in Progress (WIP). WIP days are the number of days taken from incurring WIP expenses to turning the WIP into debtors.

Debtors days

Once the job is delivered it can be invoiced, converting the WIP into debtors. Debtor days are the number of days taken from invoicing until being paid by the debtor.

Creditor days

Our costs that go into WIP are generally not paid immediately. The time taken to pay those costs decreases the time our cash is tied up. Creditor days are the number of days from incurring costs to paying for them.

Ways to improve our CCC

The shorter our cash conversion cycle, the less cash we need to tie up in the process and the less we need to find finance for. Options for improving our CCC include:

WIP days improvement

Decrease the number of days to complete a job:

- Collect all required information before starting the job, maybe using checklists and questionnaires

- Complete one job before starting another. The less jobs open at once, the more efficient the turnaround

- Staff training

Systems and technology to do the job efficiently - Measure WIP days and focus on reducing them

Debtor days improvement

Decrease the number of days to collect the cash:

- Invoice all or some of the job up front if possible

- Progress invoices for long projects

- Invoice promptly after job completion

- Agree fees in advance to avoid disputes holding up payment

- Automate prompt outstanding invoice reminders

- Improve credit control

- Measure debtor days and focus on reducing them

Creditor days improvement

Contrary to WIP and debtors, stretching out creditors improves the CCC. We are effectively using our creditors, usually cost free, to help finance our operations. Remember, the aim is to increase creditor days without affecting our business relations. Don’t screw your suppliers!:

- Negotiate good trade terms

- Monitor creditors and pay on time but not early

- Measure creditor days and focus on increasing them without affecting business

Taking control

While external funding relies on outsiders, internal cash generation is within the business owner’s control and should be our primary funding source. Ultimately, internally generated cash pays all financial obligations including servicing and repaying external funding.

Our primary planning tool for taking control of our cash flows is our financial plan. Our financial plan, including a cash flow forecast, predicts how much cash we will need and when we will need it. It is also our tool for improving our cash conversion cycle and predicting the financial impact of those improvements. Use your accountant for help preparing a financial plan for your specific business model.

Having a cash shortfall is only a problem when we don’t have time to fix it.

Contact us with your business questions

What are Profit Margins and Why Do They Matter

/in Business Development/by wp.adminWhat are Profit Margins and Why Do They Matter?

Profit margins (also called margins) matter because they are the percentage of sales that the business owner keeps. Sales of $100,000 with a profit margin of 20% generates a profit of $20,000. In other words, 80% of the sales value was used to generate the sale, leaving 20% for the business owner.

A change in margin has a greater impact on profit than an equivalent percentage change in sales. The lower the margin to start with, the bigger impact a change in the margin has.

In our example above, to achieve a $1,000 increase in profit with no change in margin, we need to increase sales by 5%, or $5,000:

Alternatively, to achieve the same increase in profit with no change in sales, we need to increase margin by just 1%:

Gross Profit Margin and Net Profit Margin

Profit can be further broken down into gross profit and net profit. Gross profit is the profit after deducting just the costs directly incurred to deliver the product or service. These direct costs, often called cost of sales, will vary as the sales volume varies.

When a bike shop sells one bike, there is a cost of that sale being the cost the shop paid for the bike. If the shop sells a bike for $1,000 after paying $600 for it, it makes a 40% gross margin on the sale.

Presuming a business has similar gross margins across all its products, the cost of sales will change approximately in proportion to sales.

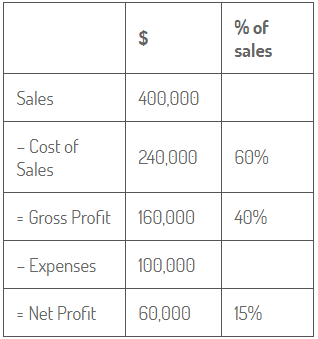

Let’s say our bike shop sells $400,000 worth of bikes in a year, with an average gross margin of 40%. Gross profit is $160,000:

Now, let’s say the shop has other expenses of $100,000 including rent, power and wages. These expenses are generally fixed, regardless of sales. These expenses are deducted from the gross profit to get to net profit.

Our bike shop has a net profit of $60,000 and a net profit margin of 15%.

While net profit is ultimately what matters, because net profit is what we keep, our gross margin is where we can influence our results. We make one-off decisions regarding fixed expenses such as whether to rent an expensive shop in a high foot-traffic area or a cheaper shop in a quiet side street. But once these decisions are made, we can’t change them month to month.

Where we can make a difference in the short-term is by focusing on our sale prices and deals with suppliers to try and improve our gross margins. I.e., widen the gap between sales and cost of sales. A small increase in gross margin converts to a large increase in net margin.

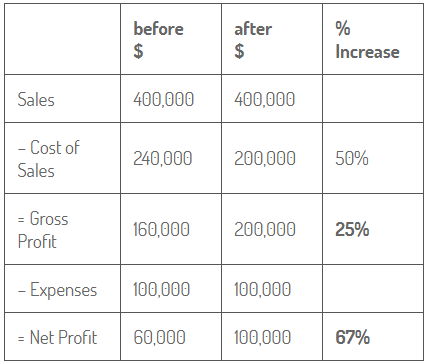

What if our bike shop managed to negotiate a lower cost from a new supplier and increased its gross margin from 40% to 50% of sales. This 10% increase in gross margin results in a 25% increase in gross profit, from $160,000 to $200,000.

The difference is magnified at net profit level. The 25% increase in gross profit converts to a 67% increase in net profit.

Margins are important and a modest improvement in gross margins, without adversely affecting other factors, can drastically change net profit. And net profit is what you can bank. It’s called the bottom line for a reason.

Contact us with your business questions.

Death by Discount

/in Business Development/by wp.adminDeath by Discount

Is Your Discounting Killing Your Business?

You sink a lot into your business — your time, money, stress. But there is no guarantee your business will ever repay you. The potential profits will stay hidden until you uncover them. To uncover them you need a high profit business design.

The key to designing your business for high profits is to focus your energy in the right places. Perhaps the most dramatic and easiest improvements can come from focusing on your prices. An example below will show you how increasing prices by 10% can increase bottom line profits by 50%.

But price increases will lose you business right?

Our natural tendency is to undervalue our products and services. It’s personal — we find it hard to ask for a ‘high’ price; especially when we’re starting out in business. We think we have to offer more for less to get business.

But that is usually not the case. People will pay what they perceive your products and services to be worth. You do provide value to your customers. Chances are you are not charging enough for that value.

How much should you charge?

First make sure you know your numbers. Calculate the true cost of delivering each unit of product or service. This includes the purchase cost to you of the product, direct labour costs, freight in and out, your time etc. Include every cost that will increase when you sell one more product or service unit. This is the cost of sales in the example on the following page.

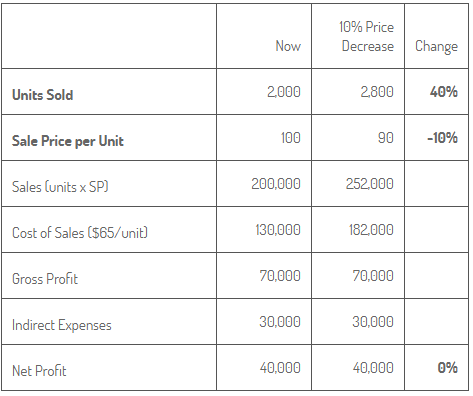

Next calculate your profitability. The business in the example below sells wooden ornaments. They are currently selling 2,000 units per year at an average sale price of $100. Each product costs the business $65 all up, delivered to the customer. After deducting the cost of sales of the 2,000 units per year ($130,000), and fixed indirect expenses of $30,000, the net profit left over for the business owner is $40,000.

If the business is typical they could probably get a bit more for their products. Say they increase their prices by 10%. Assuming their volume of sales stays the same look at the change in net profit. The 10% price increase gives a whopping 50% increase in net profit!

But if you increase your prices you’ll sell less won’t you?

Well that depends on the product. If you are undercharging now you will lose little if any sales volume. But assume your customers are price sensitive. Maybe you face stiff competition. How much can your sales volume go down, before you lose out on your bottom line?

The next example shows volume dropping by 22% in response to the 10% price increase. At this change (a fairly dramatic response to the price increase) the business still maintains the same bottom line Net Profit.

So if sales volume falls by more than 22% profit goes down, less than a 22% volume drop and profit goes up.

Beware of going the other way

And if you’re tempted to discount your prices to gain more business, the increase in volume needed to maintain your profit is even more dramatic. Look at this example with a 10% decrease in price:

A 40% increase in sales volume is needed to maintain the $40,000 net profit. This may be possible if it’s combined with a significant marketing campaign. But that is a big increase in anyone’s books.

The more differentiated your product or service, the less sensitive the sales volume is to price changes. Differentiate yourself from your competition with your branding, your service and relationships with your customers. Unless you are selling a true commodity, you can maintain sales volume with higher prices.

Real Life Examples

If you are still nervous about increasing your profits let me tell you a real example. I sent a newspaper article to a client about a competitor of hers. The article gave her competitor’s prices which were significantly higher than hers. She immediately put her prices up to match. With no other major changes in her business, a year later her profits were up 59%.

And a hair salon client of mine once told me they couldn’t understand why they weren’t busier. “We charge less for a better quality service than our competitors so why aren’t we flat out?” She asked. After asking her why her prices were lower, she could give me no good reason. So after a few weeks of thinking about it she increased all her prices. And she was amazed when she did not lose a single customer.

Even if your sales volume decreases and your profits remain the same, it will free up your most precious resource — your time. Now you can work on developing other areas of your business, and/or take more time off.

Don’t let low prices bury your profits. If you really can’t raise your prices, improve your perceived value so you can.

Are you missing out on potential profits?

We are accountants for professionals and consultants. As an expert in your field, your knowledge generates value for your clients. Our job is to make sure that value also generates your financial success.

Contact us with your business questions.

Four Steps to Better Profits

/in Business Development/by wp.adminFour Steps to Better Profits

Few solo consultants and small firms reach the above average profits they are capable of. Most do not have the basic information at their fingertips to do so. I want to highlight four steps that you can take to greatly improve your profits and cash flow.

1. Have good financial statements

You can’t fix something until you know what is happening now. Surprisingly, many small business managers have no idea how their business is going. Good financial statements are the starting point to measure the results of the business as a whole.

To make any management decisions to improve financial performance, you need financial statements that are:

- Accurate: All relevant business transactions should be processed and checks done to ensure everything is included and in the right place. Misleading information can do more harm than no information.

- Timely: It is no use looking at how you did 18 months ago. To make meaninful changes you need to know the results of your recent efforts. Monthly, or at least quarterly, accounts will keep you on the pulse of your business.

- Relevant: Well designed accounts provide a simple, clear picture of your business’s results. Unstructured and poorly thought-out accounts will confuse you. Make sure you have accounts that show the information you need, and nothing else.

2. Have a financial plan

You need financial statements to show how you’re doing. But with nothing to compare them to, it is hard to know whether the results are good or bad. When you compare your results to a plan, or budget, you can see where you are succeeding and where you are not.

The financial planning process serves two key purposes:

- First, the planning process reveals the feasibility of what you are trying to achieve. Often people create a elaborate business plan with ambitious plans. When it comes to crunching the numbers, they realise it just isn’t going to work. Don’t start on a business without knowing the numbers make sense.

- Second, the plan is the yardstick to measure your actual results against. Only by doing this can you see where things are working out and where they are not. Then you know where to focus your energies to put things right.

Without a plan you are working and hoping for the best. With a plan, you are following a thought out route with a much higher chance of reaching your destination. By regularly comparing your actual results to your plan, you will quickly see what is working and what is not.

3. Analyse results by segment

Your financial statements will show your overall business results. To identify exactly where these results can be improved, you need to know which part of your business is working and which isn’t.

A good accounting system will help you separate your results to show profit by any type of segmentation. This may be by client, service type, region if you have clients in more than one area, or by staff member if you employ other fee earners. By examining different segments, you will undoubtedly find that some areas of your business are subsidising others and the results may surprise you. It often feels like the business that is keeping you busy is making you money, but the results can reveal a different story. Armed with this knowledge, you can either fix the under-performers or put more resources into the over-performers.

David Maister wrote in his book Managing the Professional Services Firm, that it is not unusual for firms to find that 120% of their profits come from 80% of their clients. In other words, they are losing money on 20% of their clients. Those 20% are draining energy that should be used on your good clients. But until you know who they are, you can’t fix it.

4. Monitor key performance measures

You can’t track all your results all the time, but you can closely monitor two or three key indicators. When you know what you’re trying to achieve, you can identify the most important areas for you to achieve it. By closely monitoring these, you will have rapid feedback to learn and improve your performance.

The measures may change as your business evolves, and they can relate to any area of your business. The popular Balanced Scorecard approach is to divide your business into four areas and choose the objectives within those that will make the biggest difference to your results. This helps ensure you are looking at your business as a whole:

Learning and innovation

What professional and personal development will increase your ability to deliver value to your clients, profitably? How do you measure your development in this area?

Internal Processes

How can you improve your efficiency through increased skills, technology or systems? The smoother your business runs the more time you have to deliver your services.

Customers

How will you generate new work from new or existing clients, and how do you measure your success? You might track the number of new enquiries, the percentage of those that become clients (conversion rate), or the number of higher value services provided.

Financial

Where is the biggest potential to improve your financial performance? It could be increased fees, better profit margins, or improved debtor collection and cash management.

Every business will identify their own critical success factors, but they should be based on the cause and effect relationship.

Do you have gaps in the above areas? If so, by getting on top of your management information you could stop your profit leaking out.

It doesn’t need to be complicated or expensive to put these four measures in place. If you want some help, get in touch.