Business Finance Explained

Understanding your Financial Statements – Part 6

In this article, we step back and look at your business as an investment.

Being a business owner goes beyond being self-employed – i.e. being your own boss – to having an asset that you can grow into a valuable investment. You are investing, by injecting money and/or your personal effort, or “sweat equity”, into your business.

To grow your investment, you have to think like an investor, and not just a business manager.

In this article we’ll cover the following topics:

Understanding Risk vs Reward

One of the fundamental principles of investment is risk versus reward. A safe investment such as a bank deposit will generate lower rewards, such as a modest interest rate. Riskier investments, such as a share or property fund, demand higher returns on average, but less certainty as returns will fluctuate and sometimes go backwards.

If investing in a fund of publicly listed companies is risky, it is nothing compared to investing in a single small business. For this reason, small business investors such as angel investors and venture capitalists look for returns as high as 40 to 50%. A large portion of small businesses fail, taking your whole investment with them. On the positive side, you are in control of your business, so its success or failure is largely up to you.

How much is your business worth?

When you invest in businesses, whether it is a few shares in a multi-national company or 100% of your own consulting firm, you are buying an entitlement to the business’s future earnings and capital gains.

Therefore, a business’s fundamental value is based on its profits. The value increases as profits increase.

In investment jargon, a share’s value can be quantified by a price-to-earnings multiplier. I.e., the value of the business is a multiple of its earnings, or profit.

Shares in an established public company may sell for say 8 to 20 times its current profit, depending on expectations for earnings growth etc. An established small business may sell for a price multiple of 2 – 4, reflecting the much higher risk of smaller enterprises.

Let’s assume a business is worth 4 times its current profit.

If the profit is $125K, it will be valued at $500K.

Looking at it another way, the owner has a $500K investment making a 25% return (125K / 500K x 100). 25% is the return on the owner’s investment, or their equity in the business. Let’s call this Return on Equity (ROE).

To increase the return, and therefore the investment value, the business must increase profit.

Three steps to generating a Return on Equity (ROE)

We can view the overall business process as three steps:

- The business raises funds to finance business assets

- The assets are used to generate sales

- Sales are turned into profit

Return on equity is a function of these three steps.

Let’s look at each…

Raising Funds to Invest in Assets

As discussed in part 3 of this series, assets are items of value owned by the business that will bring future economic gains.

This includes tangible (physical) assets such as business equipment and cash, and intangible assets such as knowledge, systems and clients.

A business uses assets to generate sales and these assets are funded by long-term finance.

On a balance sheet, assets = liabilities + equity. I.e., the value of total assets on one side of the balance sheet is funded by an equal amount of equity and liabilities (debt) on the other side of the balance sheet.

Equity is the owners’ investment while debt is money lent from outside parties.

The mix of debt versus equity affects the ROE. While small businesses are sometimes 100% equity financed, having some debt can increase returns but will also increase risk.

The ratio of debt to total finance is called the debt ratio.

Debt Ratio Example

Returning to our example, we have a $500,000 business investment making a $125,000 profit.

If it is entirely funded by equity, the owner is making a 25% ROE (125K / 500K x 100).

Let’s see what happens to the owner’s return if the business is financed with 50% debt and 50% equity – a debt ratio of 50%.

To do this it raises a $250K loan at 10% interest. The owner now has $250K equity invested.

The annual interest charge on the loan is $25K ($250K x 10%). The interest is an expense to the company, reducing the profit to $100K ($125K – $25K).

The owner now has a return of $100K from their $250K investment, a 40% ROE, up from 25% with an all equity investment.

Important Consideration

While the business is generating a return on its assets (25% in this case) greater than the cost of its debt (10%), debt finance will increase the return on the equity.

However, debt increases risk because if the return on assets decreases to below the cost of the debt, the return on equity will decrease and, with too much debt, could go into a loss.

Turning Assets into Sales

The second factor in determining ROE is how efficiently the business generates sales from its assets.

The greater the sales relative to total assets, the higher the return.

A measure for this is asset turnover: annual sales / total assets.

This calculates the number of times per year the assets are “turned over” by sales. If our $500K business has an asset turnover of 2, it will have sales of $1,000,000 (500K x 2).

To improve the return on investment, we can either increase sales without a proportional increase in assets, or decrease assets (i.e. a lower amount invested) without a proportional decrease in sales.

Turning Sales into Profit

The final step in generating ROE is turning sales into profit.

The business needs sales to make money but only the profit is available to the owner.

Our measure of the business’s efficiency in doing this is profit margin. Profit margin is profit as a percentage of sales.

Continuing our example, the $125K profit with sales of $1M gives a profit margin of 12.5%: (125,000 / 1,000,000 x 100).

Increasing the profit margin will increase the return on investment.

Example

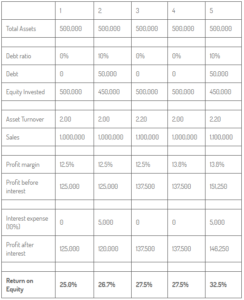

The table below shows our example business.

We have:

- A debt ratio of 0% (i.e., no debt)

- Asset turnover of 2

- Profit margin of 12.5%

The next table shows the starting point in column 1, and the effect of increasing each of the three variables by 10% in columns 2 – 4.

Column 5 shows the overall result of a 10% increase in all three variables, being an increase in ROE from 25% to 32.5%.

The 32.5% return on equity in column 5 assumes the total asset value, or value of the whole business, is still $500K.

However, we have now increased our business earnings and therefore the business value will increase.

Returning to our business valuation, if we assume that we can still demand a profit multiplier of 4, our equity investment is now worth 4 times the profit, or $585,000 ($146,250 x 4).

As our equity investment was $450K (with 10% debt finance), this is an increase in the value of our investment of $135K, or a 30% increase.

Summary – Business Finance Explained

Business ownership entitles you to a share of the business’s earnings.

Therefore, the value of your investment is determined by the business’s profits.

Profits, in turn, are a function of three factors:

- The value of assets in the business. This can be increased, relative to your equity investment, by adding in debt finance. We monitor the extent to which debt is employed using the debt ratio.

- The value of sales generated by the assets. We measure this using asset turnover.

- The profit relative to sales. We measure this using profit margin.

Investing in a small business involves significant risk but provides potential rewards way above most other investment options.

These articles have examined how to measure your business’s financial health using the information in your financial statements.

It is one thing to do the calculations, but how do you know if your results are good or if you need to improve them?

In the next article, we will look at how to put your results in perspective…

If you’re unsure about anything in this article and have more questions, feel free to get in touch.

Next Steps

Robb MacKinlay is an accountant and business advisor to professionals and consultants, helping them convert their expertise into profitable business.

Contact us with your business questions.

Did you find this article useful?

Please share this content using the social icons below and Sign Up to our mailing list to receive regular newsletters and information on relevant topics.