Profits Explained

Understanding your Financial Statements – Part 4

In the previous two articles, we looked at the Profit and Loss Statement (P&L) and the Balance Sheet and how to read them.

In this article, we will recap the P&L then dig deeper to analyse profitability, so you can make informed decisions to improve your business’s bottom line.

We’ll discuss:

Introduction

Profit is like oxygen for your business.

You may have objectives beyond making money, but without money, you won’t achieve much.

As well as providing you with a living, profit provides options. Profits are required to fund business growth and development including expanding into new service offerings or target markets.

Without profit, or an endless supply of funds from elsewhere, your business will not survive for long.

Profits Explained – Lets start with a quick recap…

Profit and Loss Recap

Revenue – expenses = profit

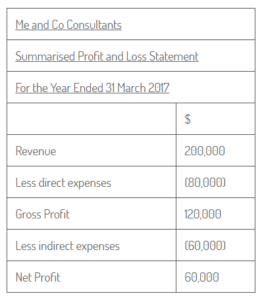

As per the second article, the P&L calculates profit. It takes total revenue and deducts business expenses to calculate the remaining profit. I.e., how much money your business has made for you, the owner. Here is a simple example:

We have subcategorised profit as gross profit and net profit.

Gross profit is profit after deducting direct expenses such as subcontractors used on chargeable jobs. Direct expenses are directly incurred to produce revenue and therefore increase or decrease as revenue increases or decreases. These are sometimes known as variable expenses as they vary with revenue.

Net profit is profit after deducting all other expenses from gross profit. The other expenses are indirect, as they are incurred to run the business but not directly to produce revenue. As they do not tend to vary as revenue changes, at least within a certain range of revenue, they are often assumed to be fixed expenses.

Gross margin

Gross margin = (Gross profit / revenue x 100)%.

Gross margin is gross profit as a percentage of revenue. It measures how efficiently you are generating revenue. A gross margin of 60% means that you are spending 40% of the revenue to generate it, leaving 60% to contribute towards indirect expenses and net profit.

Net margin

Net margin = (net profit / revenue x 100)%.

Net margin is net profit as a percentage of revenue. It measures how efficiently you are turning revenue into bottom line profit. A net margin of 30% means it is costing you 70% of your revenue to produce it and run your business.

Now let’s look at how to increase our profits.

Cost volume profit (CVP) analysis

Cost volume profit (CVP) analysis is a powerful tool for evaluating profit and how changes to the revenue, gross margin or net margin affect your bottom line.

Our “Me and Co Consultants” P&L above shows the following:

- Revenue = $200,000

- Gross margin = 60% (120,000 / 200,000 x 100)%

- Net margin = 30% (60,000 / 200,000 x 100)%

Let’s now see how a change in any one of these three variables will affect the net profit, i.e. the bottom line figure that the owners are making from their business.

Revenue

Presuming all else remains the same, an extra dollar of revenue will produce an extra 60 cents of gross profit, as the gross margin is 60%. It will also contribute an extra 60 cents to net profit, as fixed expenses do not change. All the additional gross profit is added to the bottom line.

Here is an adjusted P&L assuming Me and Co has increased revenue by 10%, from $200,000 to $220,000.

Net profit has increased by $12,000, a 20% increase (60,000 + 20% = $72,000). So, a 10% increase in revenue has created a 20% increase in net profit. While gross margin has remained the same, net margin has increased due to the indirect expenses being fixed.

Gross margin

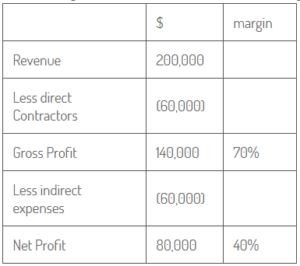

Let’s see what happens when we increase gross margins without increasing revenue.

The following P&L assumes Me and Co has increased gross margin from 60% to 70%, with revenue remaining at $200,000.

As the gross margin has increased by 10%, an extra 10%, or $20,000, of the revenue is captured as gross profit. This also translates to an extra $20,000 of net profit.

Net margin

Net margin is a result of gross margin and indirect expenses. To improve net margins without changing gross profit above, we need to reduce indirect expenses.

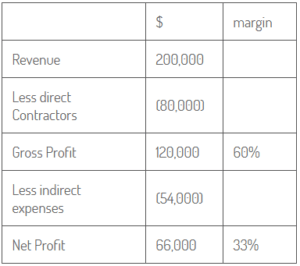

Continuing with our Me and Co Consulting example, let’s see what happens to the original P&L if we decrease our indirect expenses by 10%, leaving everything else unchanged.

A 10% reduction in indirect expenses from $60,000 to $54,000 has increased net profit by $6,000 or 10%.

Indirect expenses can be broken into discretionary and nondiscretionary.

We can control discretionary costs. An example is professional development costs. We can decide as we go whether spending $275 for a seminar will increase our ability to do our job and thus indirectly increase our long-term revenue generating ability.

Nondiscretionary costs are set in place and cannot be easily changed. If we sign a six-year office lease, we can’t choose month to month whether it is worth paying or not.

We make long-term decisions regarding our indirect expenses that will affect our profit. Healthy net margins require indirect spending to be efficient, paying for things that are necessary and helpful to facilitating our business efforts. But on a month to month basis, we should generally focus on revenue and direct expenses.

Improving Profit

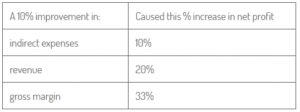

To summarise our examples above:

Improving indirect expenses can help but unless there is gross wastage, ongoing efforts should generally be focused on revenue and direct costs, i.e., gross profit.

When we look at gross profit, we often focus too much on revenue, thinking we just need more business. Sometimes, attention on gross margins can bring greater rewards without increasing our workload.

Our example looked at a consulting business starting with reasonably high gross margins. Other businesses, especially product businesses, would have lower gross margins. The lower the starting gross margins of the business, the more sensitive the net profit is to changes in the margin. So, where there is potential to increase gross margins, this can be the most effective place to start looking.

If your gross margins are already high, you can focus on increasing revenue knowing that any increase will add substantially to the bottom line.

Summary

Understanding your profits is the first step in the process of learning on how to improve them.

We are experts at analysing business profits and can help you put together a plan to achieve more success in your business. If you’d like our help to ensure you’re on the right track, please get in touch.

In our next article…

While profits fuel our business, profitable businesses still fail if they run out of cash. Take a look at our next article which looks at managing our cash flow.

If you’re unsure about anything in this article and have more questions, feel free to get in touch.

Next Steps

Robb MacKinlay is an accountant and business advisor to professionals and consultants, helping them convert their expertise into profitable business.

Contact us with your business questions.

Did you find this article useful?

Please share this content using the social icons below and Sign Up to our mailing list to receive regular newsletters and information on relevant topics.